[ad_1]

Pattern-following buying and selling might be the most well-liked method for merchants to generate buying and selling indicators. Merchants anticipate that through the use of a trend-following buying and selling method they may have the ability to notice bigger profitable trades by capturing long-lasting trending actions.

On this article, I’m introducing 5 frequent and highly effective methods to search out trend-following buying and selling alternatives and I’ll stroll you thru the totally different chart research to boost your understanding of trend-following buying and selling generally.

What’s Pattern Following

Because the identify suggests, utilizing a trend-following buying and selling method, merchants first should establish an present trending market after which they seek for buying and selling alternatives that revenue when the development continues.

The primary problem, subsequently, is figuring out a trending market, and right here merchants could make use of various buying and selling instruments and ideas which we’ve explored in a unique article: establish the development path

The advantage of trend-following buying and selling is that when a dealer is ready to catch a long-lasting trending transfer, the revenue potential could also be very giant.

One other necessary facet of trend-following buying and selling is that merchants should notice that as a trend-following dealer, you won’t be able to seize the entire trending transfer. Since trend-following merchants should look ahead to a development to determine first, by definition, they can’t seize the primary a part of a development. Particularly new and inexperienced merchants make the error of making an attempt to foretell when a brand new development will emerge earlier than there are precise indicators {that a} development is current. This predicting mindset will be harmful as a result of the dealer is tempted to take trades too early after which notice pointless losses. Ready for a development to emerge and being affected person are necessary expertise that trend-following merchants should develop.

However now let´s get into the sensible a part of this text and let´s discover the 5 trend-following buying and selling methods that I’ve chosen. The methods on this article are, in no way, full and I’d suggest utilizing them as an inspiration for constructing your personal buying and selling technique across the talked about ideas. Additionally, a stable backtest is beneficial at first, earlier than you progress into demo buying and selling and, lastly, commerce actual cash to guage the effectiveness.

Chart Sample Continuations

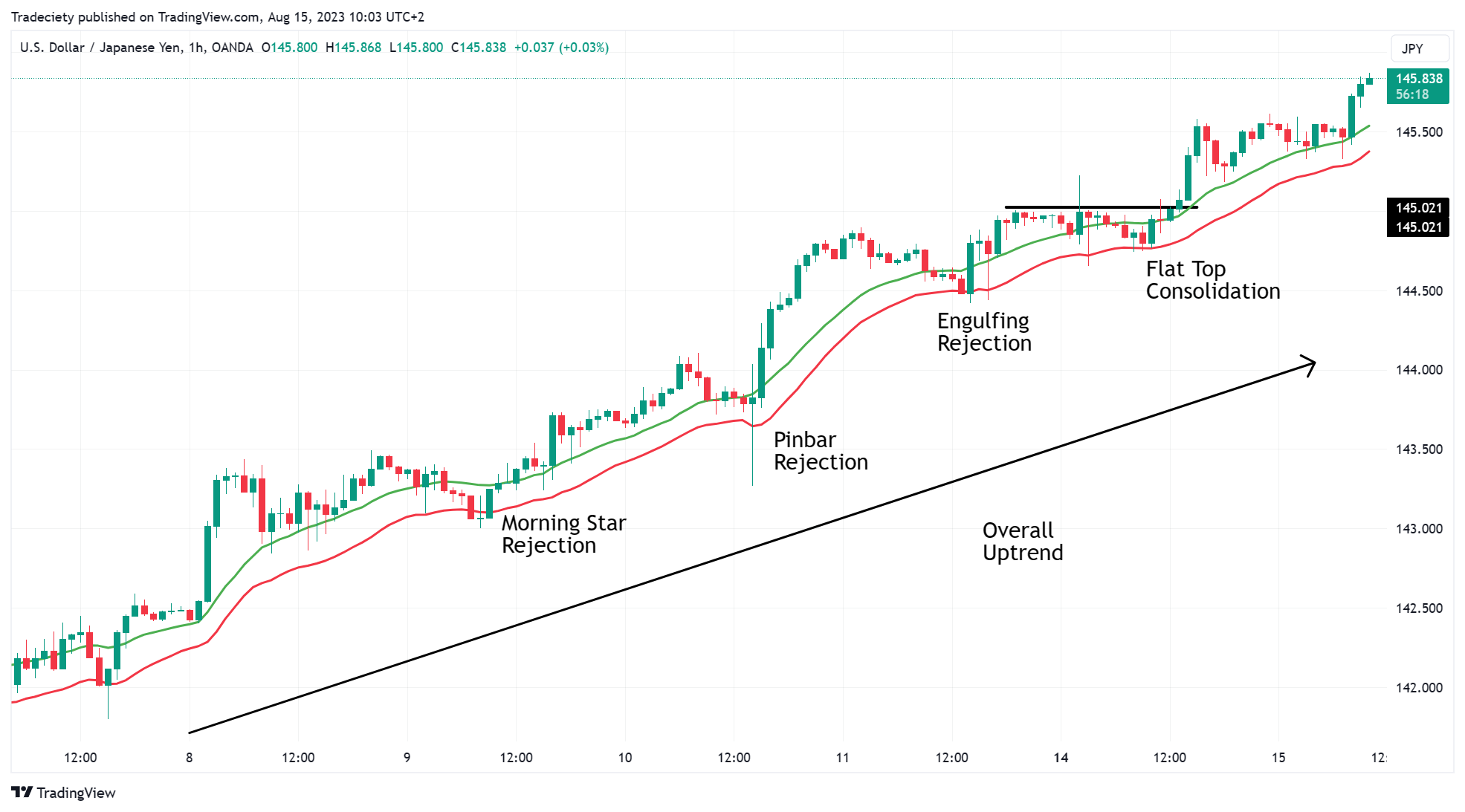

The basic method of buying and selling development continuations makes use of chart patterns and value motion ideas. Chart patterns are so-called connectors as they join trending phases throughout trending markets. Traits don’t transfer in a straight line and the value often goes forwards and backwards. Chart patterns can usually be discovered throughout the corrective development phases as the continued development is pausing. A breakout from a chart sample usually indicators a development continuation.

Within the screenshot under, we will establish a downtrend (bearish development) as the value is shifting decrease. Through the general development, we will observe phases throughout which the downtrend is pausing. The primary section confirmed the traits of a rectangle with horizontal help and resistance boundaries. As a trend-following dealer, you need to keep away from buying and selling inside a sideways correction as a result of the value is simply bouncing up and down. Ideally, the dealer is ready for an in depth of the value under the help degree earlier than taking trend-following trades.

At present, the value is exhibiting a flag consolidation sample. A flag sample is outlined by diagonal trendlines that run reverse to the continued development. The worth is simply breaking out of the flag, signaling a possible development continuation.

After the breakout, the development continues and the development superior decrease.

Shifting Common Channel

Though many merchants consider that value motion buying and selling is superior to indicator indicators, I’d not dismiss the ability of buying and selling indicators and even among the finest merchants of all instances are utilizing indicators of their buying and selling.

Within the following chart, I’ve utilized a shifting common channel consisting of two shifting averages with the identical 20-period setting; one is utilized to the excessive and one to the low. You possibly can simply set this up in your Tradingview by opening the settings of the shifting averages and altering the “supply” to excessive and low.

Shifting averages are the proper buying and selling instrument for trending markets as they usually describe the development successfully. Within the screenshot under, we will see that the bullish development is advancing above the shifting common channel. Pattern-following merchants are in search of indicators when the value is shifting again into the channel after which they commerce the rejection away from the channel.

As we comply with the bullish development, we will see a number of circumstances when the value moved again into the channel after which rejected the channel earlier than advancing greater. Such indicators could present nice trend-following alternatives.

The advantage of utilizing indicators is that the indicators are 100% goal. New and inexperienced merchants usually wrestle with the subjective nature of pure value motion buying and selling; an indicator may be an important addition to your arsenal if you’re in search of an goal instrument to enrich your decision-making.

Trendline Bounce

Trendlines, as their identify suggests, are buying and selling instruments which might be solely used for trending markets. Trendlines describe a trending section the place a dealer connects the low factors in an uptrend (and the excessive factors throughout a downtrend). For a trendline, you require three touchpoints to be legitimate.

Within the state of affairs under, we join the primary two low factors of the uptrend. Now, the value is again on the trendline for a 3rd time and is testing the extent as help. Pattern-following merchants are ready for indicators that the trendline is holding as help to provoke bullish trades within the trending path.

Trendlines are additionally nice instruments to make use of inside a multi-timeframe method whereby merchants establish trendlines on a better timeframe (the Every day or 4H) after which search for chart patterns and rejection indicators on a decrease timeframe (1H or decrease).

Trendlines are an important instrument for trend-following buying and selling as a result of, by timing commerce entries round a trendline, the dealer is ready for the value to tug again considerably as a substitute of chasing the value because it strikes into the development path. Merchants are, subsequently, in a position to purchase a trending market at a reduction at a considerably cheaper price, optimizing their reward:danger ratio.

Pivot Level Pattern-Following

Though pivot factors are thought-about an indicator, they’re greater than that as a result of they’re utilizing necessary value parts. The central pivot level that I’ve activated within the following charts is offering the typical value of yesterday´s value motion. As trend-following merchants, utilizing the typical each day value is necessary on your general understanding of the trending setting.

Within the screenshot under, the value was first in an uptrend on the left. Through the uptrend, the value traded above the pivot level, and every new pivot level is greater than the earlier one; the pivot level can, subsequently, verify a trending market. On the proper, we now see two consecutive decrease pivot factors. A change in pivot level path can usually foreshadow a change within the trending setting.

Through the newly unfolding downtrend, the value retains pushing into the pivot level and constantly rejects it. Such pivot level retests may be used as buying and selling indicators in a trend-following technique.

The downtrend continued, exhibiting repeated rejection indicators on the pivot factors. On the very proper, the value now began to commerce above the pivot level. A protracted-lasting value transfer above the pivot level will be the primary signal that the prior downtrend may be coming to an finish.

Stochastic Using

When merchants take into consideration the STOCHASTIC indicator, they first take into consideration buying and selling overbought and oversold indicators. However what if I advised you that it is a improper and harmful method of utilizing the STOCHASTIC indicator?

The STOCHASTIC indicator is a pure momentum indicator which implies that the STOCHASTIC analyzes how strongly the value and a development are shifting. A excessive STOCHASTIC, subsequently, indicators a really sturdy trending market. Going towards the STOCHASTIC could be the improper choice.

Within the screenshot under, I put the STOCHASTIC indicator under the value chart and, as you may see, the uptrend is unfolding because the STOCHASTIC stays above the 80 degree, which most merchants would name overbought and would search for shorting alternatives. Clearly, this may have been the improper buying and selling plan.

Let´s comply with one other chart research by wanting on the STOCHASTIC indicator. The worth has damaged above the horizontal resistance degree and the STOCHASTIC indicator shortly after has moved into the “overbought” space, above 80. At this level, the indicator indicators a powerful trending market. Any longer, in search of bullish trend-following buying and selling indicators may present higher buying and selling alternatives.

As we will see, the bullish development saved going for a very long time whereas the STOCHASTIC stayed above the 80 degree.

Don’t dismiss indicators too quick and, as a substitute, attempt to perceive their true which means. The STOCHASTIC indicator is the perfect instance of how merchants usually have a improper understanding of their buying and selling instruments after which consider that they’re “not working”, whereas they’re making use of their instruments within the improper context.

Closing Phrases

Relating to trend-following buying and selling, we will discover an abundance of buying and selling methods and totally different methods. And though this text defined solely 5 methods for buying and selling trending markets, the underlying ideas of trend-following buying and selling are at all times the identical.

First, you establish a trending market after which you may select from all kinds of instruments and ideas to find out buying and selling alternatives within the development path. Pullback and breakout ideas are often the frequent selections hereby.

Moreover, merchants shouldn’t neglect the significance of commerce exits. And particularly in a trend-following method, exits could make or break a buying and selling technique. The objective of a trend-following buying and selling technique is to optimize giant winners by catching long-lasting trending phases. When you have been making an attempt to commerce a trend-following technique however you haven’t seen the success that you just had been hoping for, analyze your exit method and consider its effectiveness in your buying and selling journal. Each time I work with merchants, I usually see an enormous potential for enchancment in relation to exit methods.

[ad_2]