[ad_1]

A number of summers in the past, a lady named Nancy Cavaliere stopped by a New York Salvation Military on her approach residence from work.

At first, little caught her eye. However as she was on the best way out, she noticed 4 black plates with geometric faces painted on them. She determined they’d look good in her residence. And at $1.99 every, they weren’t going to interrupt the financial institution.

What occurred subsequent is the stuff of legends…

And it explains why the wealthiest 1% maintain getting richer.

Curious? Learn on.

OMG – Picasso

After bringing the plates residence, Nancy turned to Google and began looking out.

She shortly realized she’d struck gold.

The plates had been painted by Picasso. They had been a part of his “Visage Noir” sequence of hand-painted ceramics. He’d produced them in a studio in Madoura, France within the Forties.

As she says, she “virtually cried, handed out, pissed on myself–I am not mendacity.”

The following yr, she offered three of the 4 plates at public sale home Sotheby’s.

One offered for about $12,000, one offered for about $13,000, and one offered for about $16,000.

Add it up and that is $41,000. From an $8 funding. That is a achieve of 512,500%.

And that does not embody the fourth plate, which Cavaliere plans to promote in about 20 years so she can provide the cash to her daughter, maybe for a visit round Europe.

A 512,500% revenue from a number of plates?

May make you marvel:

“What is going on on right here… And the way can I get in on the motion?”

The Best Retailer of Wealth

The ethical of the story right here is not to go looking for buried treasure at your native Salvation Military. That is unlikely to be a successful funding technique.

As an alternative, to grasp what is going on on right here, it is vital to recollect one thing:

In risky and scary markets like we’re experiencing at this time, the rich have at all times discovered methods to guard and develop their wealth.

For instance, they spend money on luxurious residences in New York or London, or in bars of gold.

However just lately, they have been turning to one thing new: artwork.

The CEO of BlackRock, the world’s largest asset supervisor, calls artwork “one of many biggest shops of worldwide wealth.”

BlackRock has about $10 trillion in property underneath administration, so when its CEO makes a declare, it actually pays to hear.

Three Causes the Rich Put money into Artwork

There are various causes that artwork will be such a strong funding.

For starters, it supplies diversification. So even when the inventory market retains crashing prefer it’s been doing just lately, artwork can continue to grow in worth.

Moreover, artwork presents a hedge in opposition to inflation. In inflationary instances like we’re in at this time, that is a priceless trick.

However maybe most vital of all, artwork can present market-beating returns.

For instance, since 1995, one common artwork index has outperformed the broad-based S&P 500 by practically 3x.

Maybe these advantages assist clarify why, in response to the Knight Frank International Wealth Report, 37% of people price at the very least $30 million gather or personal advantageous artwork.

However now, artwork is not only for the tremendous rich anymore…

Introducing: Masterworks

Masterworks is a web-based platform for artwork funding.

It goals to make blue-chip art work investable for everybody.

The best way it does so is thru fractional investments. For instance, even when a bit of artwork is promoting for thousands and thousands of {dollars}, you should purchase a small fraction of it.

In lots of instances, minimums are simply $100, and generally they’re as little as simply $20.

Moreover, you’ll be able to promote your fractional shares to different traders by Masterworks’ secondary market. Definitely, there aren’t any ensures that somebody will purchase your shares. However because the platform grows in reputation, it is seemingly that liquidity will develop.

As they are saying, previous efficiency isn’t any assure for future outcomes. That stated, Masterworks has a observe file of successful efficiency. For instance:

- A portray it supplied by George Condominium earned an annualized internet return of 21.5%.

- A portray it supplied by Cecily Brown earned an annualized internet return of 27.4%.

- And a portray it supplied by Banksy earned an annualized internet return of 32%.

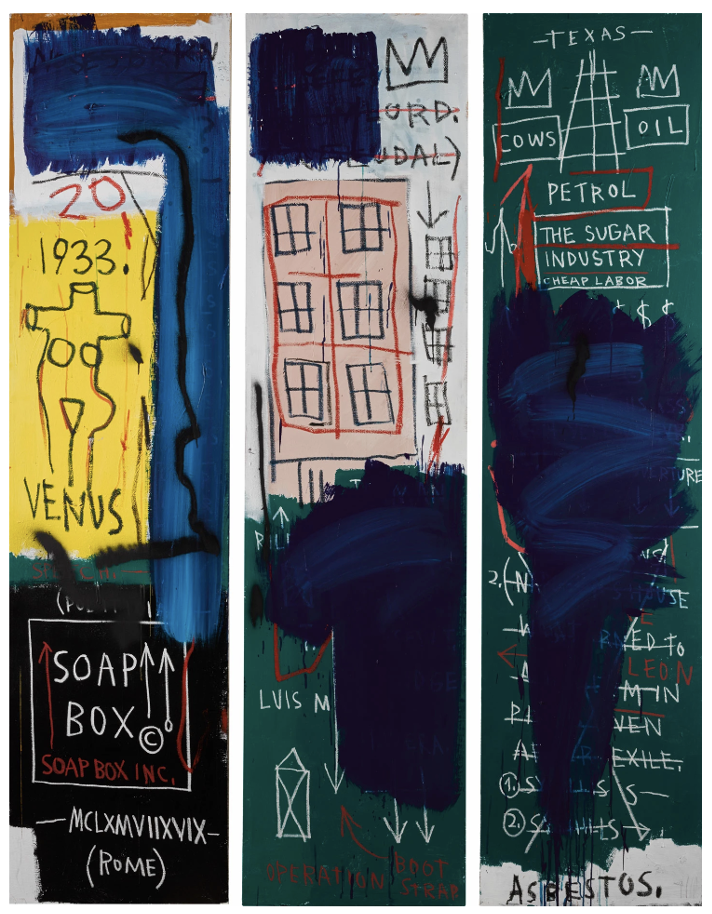

Its present choices embody items by Basquiat:

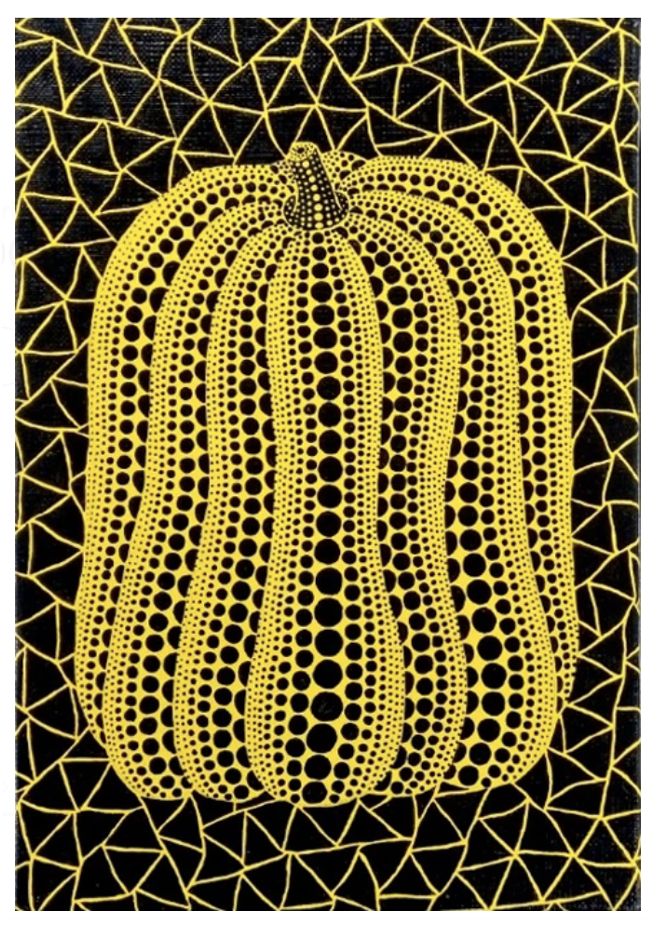

Yayoi Kusama:

And Keith Haring:

Get Began At this time

As famous earlier, with Masterworks, you do not want thousands and thousands of {dollars} to get began. You possibly can usually make investments with as little as $20.

Have in mind, all the standard caveats about investing apply right here:

For instance, do not make investments greater than you’ll be able to afford to lose; spend money on what you realize; and be sure you dip your toe into the water earlier than diving in.

Moreover, regardless of Masterworks’ secondary market, its artwork might not be fully “liquid.” Which means these investments cannot essentially be transformed into money on the snap of your fingers.

So do not make investments your lease or grocery cash right here.

However if you happen to’re trying to make investments just like the wealthy – and you are not having a lot luck on the native Salvation Military – Masterworks is usually a good spot to begin!

You possibly can be taught extra right here »

Completely satisfied Investing

Please observe: Crowdability has no relationship with any of the startups or funding platforms we write about. We’re an unbiased supplier of schooling and analysis on startups and various investments.

Greatest Regards,

Founder

Crowdability.com

[ad_2]