[ad_1]

You understand who’s received some huge cash?

And no, I’m not speaking about Elon Musk. (In accordance with Bloomberg, even after dropping $200 billion since 2021, he’s nonetheless value $251 billion.)

I’m speaking about schools.

Within the U.S. alone, schools are sitting on greater than half a trillion {dollars}.

Moreover, whereas most buyers received killed final yr because the market crumbled, some universities didn’t lose a dime. And that’s after they had been up fifty % in 2021.

So right this moment, I’ll reveal their funding secret — and clarify how one can begin utilizing it proper now.

Endowments Are Large Enterprise

An endowment is a pool of cash a college controls that helps help its mission. A lot of this cash comes from donations from alumni.

Colleges use a small quantity of their endowment yearly (typically about 5 %) for issues like scholarships, salaries for professors, and upgrades to highschool services.

The remainder of the cash, they make investments.

And since we’re speaking about a whole lot of billions of {dollars} — Harvard alone is sitting on $50 billion — the individuals accountable for investing it are a few of the finest and brightest.

So, how precisely do one of the best and brightest make investments?

The Endowment Funding Mannequin

When atypical people make investments, most of them stick to shares and bonds.

For instance, many Principal Avenue buyers have a portfolio of 60% shares, 40% bonds.

A 60/40 portfolio is supposed to supply progress in addition to stability. So even when your shares are crashing, your bonds ought to hypothetically maintain you above water.

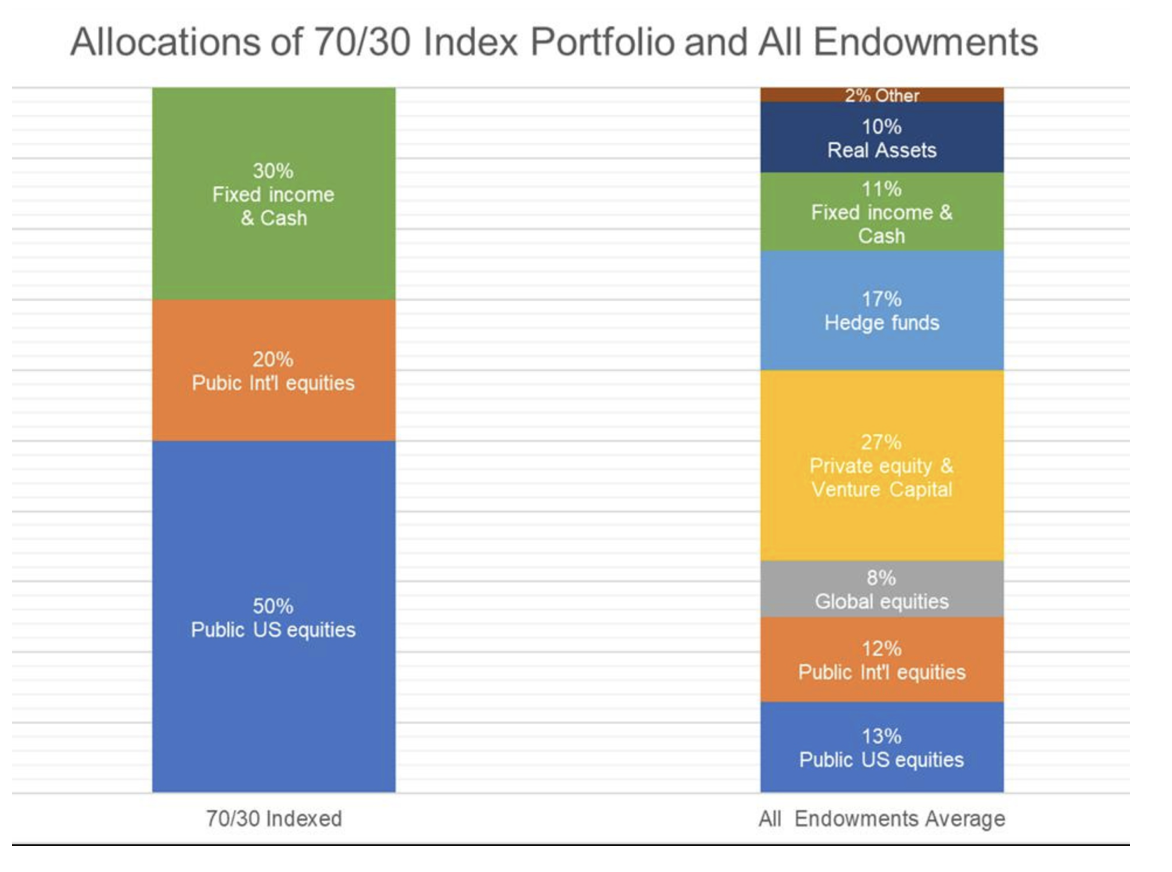

Extra not too long ago, atypical buyers have began including worldwide shares. So now their portfolios are 70% shares (50% U.S., 20% worldwide), 30% bonds and money.

However universities make investments in another way. Particularly:

- They spend money on many different asset lessons apart from shares and bonds.

- They allocate much more of their capital to “illiquid” property — in different phrases, property that may’t essentially be changed into money on the drop of a hat.

- They allocate far much less of their capital to property which have low anticipated returns, like money.

Right here’s a chart, courtesy of GritALTS, that exhibits the distinction between the portfolios of Principal Avenue buyers (on the left) and College Endowments (on the appropriate).

As you may see on the appropriate, endowments make investments closely in “different” property, like those I’ve been writing you about so incessantly these days (for instance, right here and right here.)

As you may see on the appropriate, endowments make investments closely in “different” property, like those I’ve been writing you about so incessantly these days (for instance, right here and right here.)

Such property embrace actual property, enterprise capital, and personal fairness.

This funding technique has been round for many years. It was initially developed by the Chief Funding Officer of Yale College within the Eighties, and was progressively copied by different universities in addition to legendary buyers like Ray Dalio from Bridgewater Associates, the world’s largest hedge fund.

The Proof Is within the Pudding

How has this mannequin carried out?

Properly. Actually, very properly.

In 2021, universities utilizing this mannequin (together with Dartmouth, Bowdoin, and Princeton) delivered returns of roughly 50%. That’s almost triple the Dow’s 18.7% return.

And in 2022, when most buyers received demolished by 20% or extra, Cornell was solely down by about 2%, and College of Pennsylvania didn’t lose a dime.

That’s what can occur when you might have a higher allocation to “different” investments.

The Critics Say…

So, must you purpose to make use of the Endowment mannequin too?

Some critics say no.

They argue that the success of the mannequin is essentially because of the assets and experience of the portfolio managers — the “finest and brightest” buyers I discussed earlier.

Moreover, they are saying it’s too complicated and dear for particular person buyers to get entry to such investments.

However right here’s what we are saying:

The critics ought to be ashamed of themselves!

Dip Your Toe within the Water

The info is obvious:

As you simply realized, diversifying into different property supplies clear monetary advantages in good occasions and unhealthy.

And thru Crowdability, not solely are you able to learn to get entry to the “finest and brightest” different portfolio managers…

However you will get began with minimal investments of $1,000, $100, or typically simply $10.

In order you’re placing collectively your funding recreation plan for the long run, make sure to embrace different property…

And make sure to maintain studying these pages!

Pleased Investing!

Finest Regards,

Founder

Crowdability.com

[ad_2]