[ad_1]

I learn one thing within the information yesterday that blew my thoughts.

A sweater simply offered for $1.1 million.

It’s a wool sweater, the sort you’d put on to a tailgate celebration, or to go apple selecting, or to get amusing at your organization’s “ugly” Christmas sweater celebration.

Greater than one million bucks for a sweater?

What’s happening right here? And how will you get in on the motion?

Heat & Great

The sweater in query was created by the model Heat & Great, which was based within the Seventies by Joanna Osborne and Sally Muir.

Right here’s what it appears like:

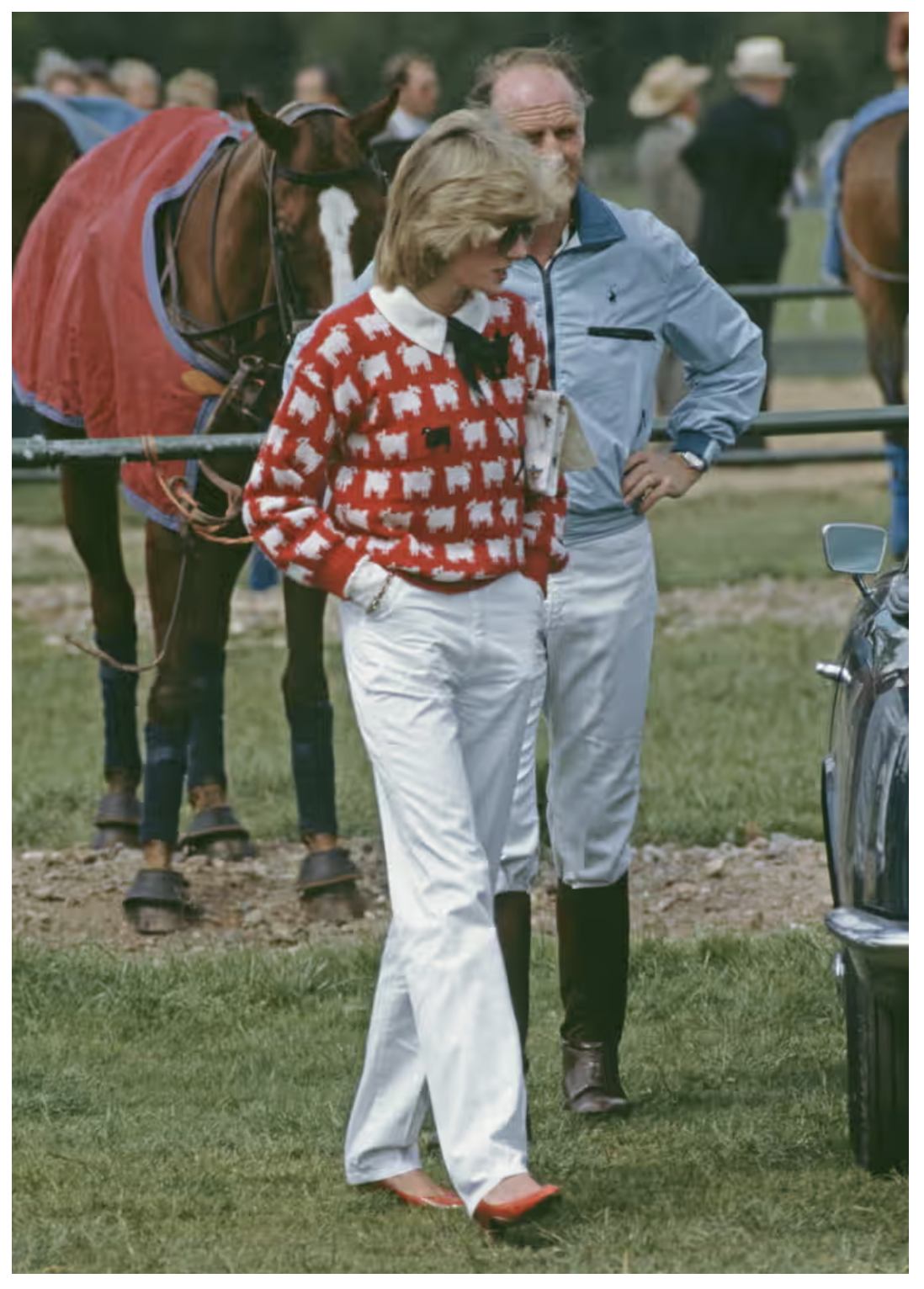

Hmm. A purple sweater embellished with a number of dozen white sheep and one black sheep.

Look acquainted?

I’ll offer you a touch:

It was worn by a well-known member of the British royalty.

Ding ding ding! That’s proper. It was worn by Diana, Princess of Wales.

Right here’s a photograph of her carrying it:

The factor is, the sweater within the image above was a alternative.

You see, a couple of month after Diana wore it for the primary time, Osborne obtained a letter from Buckingham Palace saying it had been broken. It’s not each day you obtain a letter from Buckingham Palace. As Osborne tells it, “We have been somewhat appalled, so we instantly changed it.”

For many years, it was believed the unique sweater had been misplaced.

However in March of 2023, Osborne got here throughout it whereas she was cleansing out her loft — and he or she shortly put it up for public sale…

The Most Invaluable Sweater Ever Offered at Public sale

The venerable public sale home Sotheby’s dealt with the sale of the sweater.

Previous to the sale, Sotheby’s estimated it would fetch $50,000 to $80,000.

However these days, with so many buyers turning to “collectibles” like this one as a substitute for shares and bonds…

Maybe the sale worth of greater than $1 million was inevitable.

Let me clarify.

An Different to Shares and Bonds

To kick issues off right here, let me summarize how most individuals make investments:

Most folk follow shares, bonds, and ETFs. In the event that they’re actually adventurous, perhaps they’ll add some bitcoin.

However the wealthy make investments otherwise. And this distinction would possibly clarify why they hold getting richer.

You see, based on latest analysis from Motley Idiot, the wealthy primarily put money into “different belongings.” What are these options? For starters, they embrace non-public startups and personal actual property offers — the sort we give attention to right here at Crowdability.

However in addition they embrace collectibles like artwork, baseball playing cards, and also you guessed it, clothes.

As of 2020, the rich held about 50% of their belongings in these different investments, and simply 31% in shares. The rest was in bonds and money.

Why would they do such a factor? Let’s have a look.

Three Causes the Rich Spend money on Alternate options

For starters, investing in different belongings offers diversification. So even when the inventory market is crashing, these belongings can continue to grow in worth.

Moreover, they provide a hedge towards inflation. In inflationary occasions like we’re in at the moment, that’s a useful trick.

However maybe most necessary of all, they will present market-beating returns.

For instance, over the past 25 years, early-stage startup investments have delivered annual returns of 55%. That’s about 10x greater than the historic common for shares.

And in the meantime, based on the Motley Idiot, over the past decade:

- Wine has shot up 127% in worth.

- Basic vehicles have gone up 193%.

- And uncommon whisky is up an astonishing 478%.

So, how will you get in on the motion — earlier than this stuff turn into so useful, and for simply lots of of {dollars} as an alternative of thousands and thousands?

Investing in Collectibles

Lately, a brand new sort of web site has emerged to present unusual folks the flexibility to take a position small quantities of cash into all the things from effective wine to effective artwork.

Primarily, identical to you should buy a $100 stake in a startup, now you should buy $100 price of a classic Bordeaux, a traditional piece of artwork from Keith Haring, or a multi-million-dollar sweater, costume, or sneakers utilized by a star like Princess Di.

For instance, on Otis, you possibly can put money into collectibles together with baseball playing cards, limited-edition sneakers, artwork, and watches.

And on Rally Rd, you could find all the things from classic Porsches to one-of-a variety choices just like the double-necked guitar utilized by Slash from Weapons N’ Roses. It additionally presents a secondary market, so you possibly can intention to promote your investments at any time.

You may make investments no matter you’re snug with — $100 right here, $100 there — and when the merchandise sells, you obtain your income in relation to how a lot you place in.

Watch Out!

Be mindful, all the standard caveats about investing apply right here:

For instance, don’t make investments greater than you possibly can afford to lose; put money into what you understand; and you should definitely dip your toe into the water earlier than diving in.

Moreover, many different investments aren’t fully “liquid.” Meaning they will’t essentially be transformed into money on the snap of your fingers.

So don’t make investments your lease or grocery cash into these choices.

However if you happen to’re trying to make investments just like the wealthy — and even if you happen to’re simply searching for an “ugly” sweater to put on to this 12 months’s vacation celebration — platforms reminiscent of Otis and Rally could be a good spot to begin.

Pleased Investing.

Greatest Regards,

Founder

Crowdability.com

[ad_2]