[ad_1]

The credit score bureaus have gotten fintech firms.

In an trade first, Experian is now providing a digital checking account and debit card referred to as Experian Good Cash™ Digital Checking Account. It comes with Experian Increase inbuilt, so that’s the hook.

Experian Increase is an opt-in service that permits shoppers to probably get credit score for paying common payments on time equivalent to lease, utilities, mobile phone and streaming providers.

It at the moment has 14 million folks signed up. This new account from Experian will robotically detect transactions which might be eligible for Experian Increase and add them to a client’s Experian credit score file, probably growing their credit score rating.

The checking account is obtainable in partnership with Neighborhood Federal Financial savings Financial institution and affords the usual fintech options equivalent to early entry to your paycheck, free ATM transactions, invoice pay and no month-to-month charges.

Whereas the fintech checking account house is crowded this might appeal to these people who find themselves extremely motivated to extend their credit score rating.

FEATURED

Experian launches new digital checking account & debit card

SPONSORED

See Who’s Attending the American Fintech Council Coverage Summit

Don’t miss crucial Fintech Coverage Summit of 2023. Audio system embrace: Congressman French Hill, Congressman Mike Flood, Renauld Laplanche, Co-Founder & CEO, Improve, and plenty of extra.

FROM FINTECH NEXUS

The altering, customer-centric financial institution

Competitors, regulatory stress and altering buyer preferences are driving banks to refocus on their clients.

PODCAST

Podcast: Easy methods to construct a $60B quantity international funds platform, with Rapyd CEO Arik Shtilman

WEBINAR

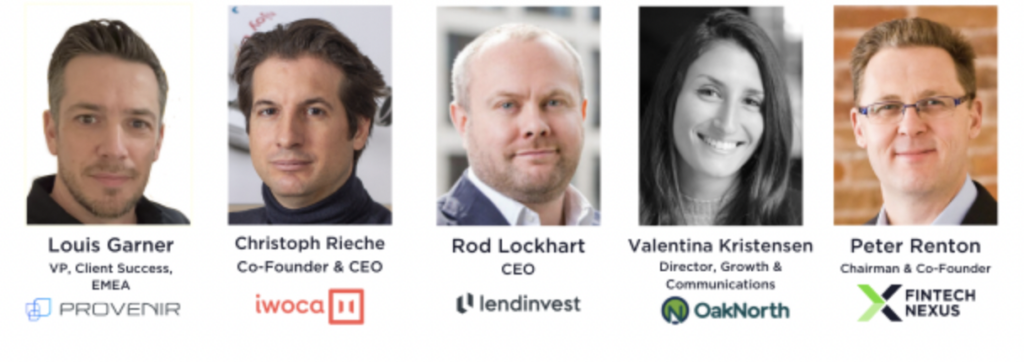

Traits in digital lending for 2024: AI, automation, embedded finance and extra. After registering, you’ll obtain a affirmation e mail about becoming a member of the webinar.

Oct 10, 9am EDT

As we start to look to 2024, we are able to anticipate expertise to proceed to have a profound influence on client lending.

ALSO MAKING NEWS

[ad_2]