[ad_1]

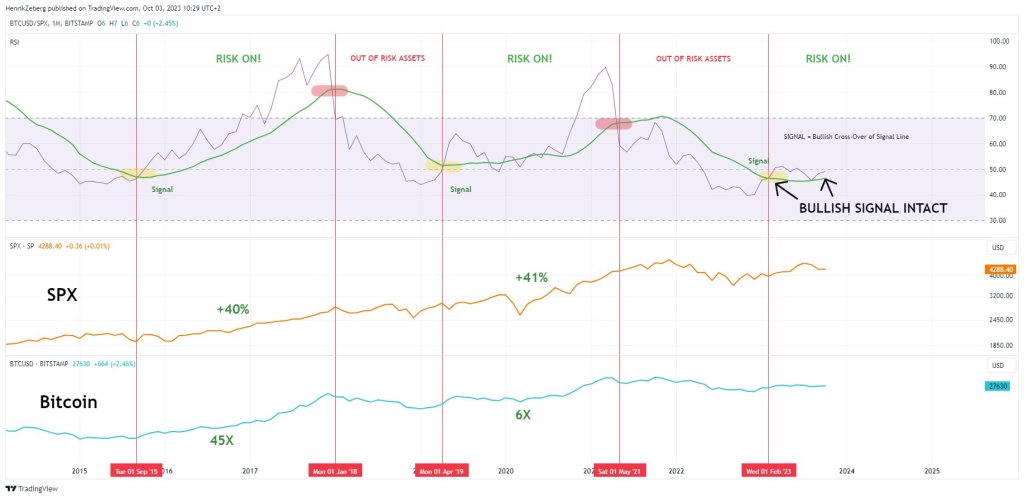

Macro-economist Henrik Zeberg thinks Bitcoin (BTC) and different threat property are gearing up for a “monster” transfer, with the development nonetheless in its early levels. Zeberg’s predictions are based mostly on the BTC/SPX Ratio, an indicator that compares Bitcoin’s efficiency to the S&P 500 index (SPX).

BTC/SPX Ratio Says There Is A Monster Transfer Incoming

Regardless of current fluctuations and issues in regards to the crypto market’s sustainability, Zeberg stays bullish on BTC. Within the analyst’s view, the BTC/SPX Ratio presents robust proof that the Bitcoin uptrend is “simply beginning.” Primarily based on worth actions, the present leg down in September might present alternatives for merchants to build up.

The BTC/SPX Ratio is an indicator that assesses the relative efficiency of Bitcoin and the inventory market. The ratio is derived from dividing the Bitcoin and S&P 500 index (SPX) spot costs. When it’s rising, like it’s presently the case, it signifies that Bitcoin is outperforming the inventory market. Conversely, a declining ratio means that Bitcoin is underperforming. In that case, banking on the inventory market might generate higher returns than HODLing BTC.

From the chart shared on October 3, Zeberg stated a “bull” sign was triggered in February 2023, previous a considerable rally in Bitcoin’s worth. By July 2023, Bitcoin had surged to roughly $32,000. Whereas there was a cooling-off interval since then, Bitcoin is trending above February highs at round $25,200, confirming the uptrend.

Between April 2019 and Could 2021, when the same bull sign was printed, BTC soared by 6X, whereas the S&P 500 noticed a extra modest improve of 41%. Zeberg’s evaluation, based mostly on the BTC/SPX Ratio, means that Bitcoin–and different threat property, by extension, can publish robust positive aspects within the months forward.

Will Bitcoin Fly To $200,000 This Bull Run?

Whether or not this will likely be printed or not can solely be speculated. Trying on the BTC/SPX Ratio, the indicator is lagging and doesn’t exactly seize market peaks or bottoms.

As an illustration, the final bear sign in Could 2021 was months forward earlier than Bitcoin peaked in November 2021 and fell. Subsequently, whereas the bull sign was recorded in early February 2023, it’s unclear whether or not there will likely be one other leg down earlier than costs rise or bears press on, pushing the coin again to 2022 lows.

If patrons take management and the BTC/SPX Ratio indicator is appropriate, it’s inconceivable to find out how excessive BTC will rise at present charges. If the final bull run is something to go by, BTC might surge by 6X. In that case, BTC might rally and push past $200,000 on this bull cycle.

[ad_2]