[ad_1]

Bitcoin has noticed a pullback prior to now day, however these elements might suggest that the cryptocurrency’s rally can proceed.

These Components May Counsel A Bullish Consequence For Bitcoin

A few days again, Bitcoin had began observing some sharp upward momentum, and by yesterday, the cryptocurrency had managed to breach the $28,500 stage. Prior to now day, nevertheless, the asset has registered a decline, falling under the $27,500 mark.

Whereas it’s unsure whether or not the rally is over or not, some indicators could be optimistic for the buyers. As defined by the on-chain analytics agency Santiment, two constructive developments have occurred associated to Tether (USDT), the most important stablecoin within the cryptocurrency sector.

The primary indicator of relevance right here is the “USDT provide on exchanges,” which measures the proportion of the whole circulating provide of the stablecoin within the wallets of all centralized exchanges.

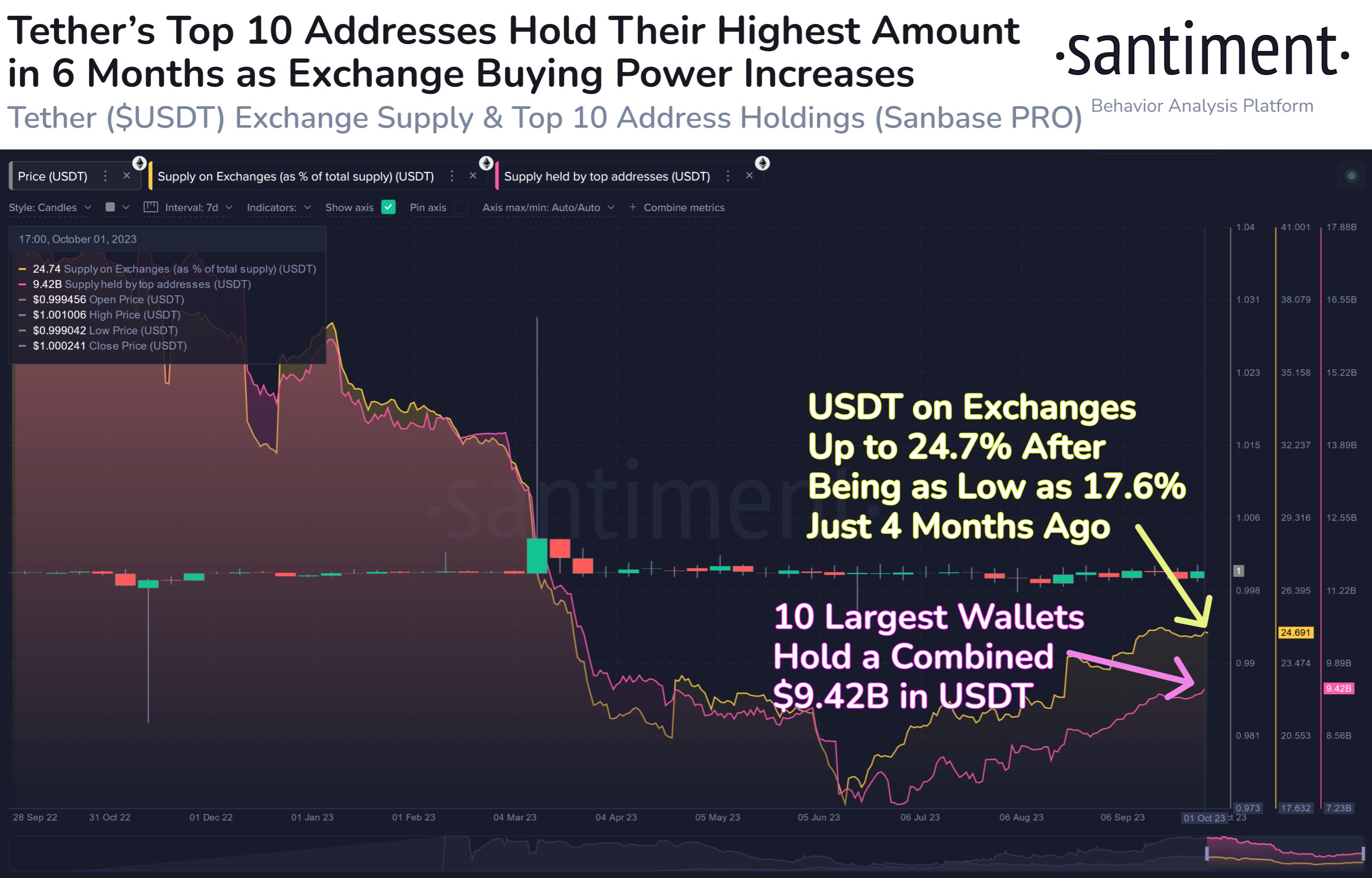

Here’s a chart that reveals the development on this Tether metric over the previous 12 months:

It seems to be like the worth of the indicator has been heading up in latest weeks | Supply: Santiment on X

Often, buyers retailer their capital within the type of a stablecoin like USDT at any time when they wish to keep away from the volatility related to the opposite belongings within the sector. Such buyers typically plan to return into the risky aspect of the market finally, although, as they might have as an alternative gone for fiat in the event that they didn’t.

As soon as these holders really feel the time is correct to dive into Bitcoin and different cash, they commerce their stables for his or her desired cryptocurrencies. Naturally, such a shift offers a bullish enhance to no matter belongings they purchase utilizing their stablecoins.

Buyers typically use exchanges for conversions like these, so the present provide on these platforms could be thought of potential dry powder able to be deployed into BTC and others.

The graph reveals that the Tether provide on exchanges had plunged to a low of 17.6% a couple of months again, implying that the obtainable shopping for stress from the stablecoin had run out.

Apparently, this low in June had occurred within the leadup to a pointy Bitcoin rally, implying that the plunge within the trade reserve of the stablecoin was, in actual fact, due to it being transformed into the asset, thus offering the gasoline for the surge. Nevertheless, the rally again then couldn’t be sustained, as BTC finally confronted a battle.

Within the months since this low, USDT reserves have slowly constructed again up on exchanges, as 24.7% of the stablecoin’s provide is now sitting on these platforms. Not like that earlier rally, it might seem that this newest surge has a retailer of potential shopping for energy obtainable that could be deployed at any time.

Within the chart, Santiment has additionally connected the info for an additional metric: the mixed provide of the ten largest Tether whales. It will seem that these humongous buyers have additionally elevated their holdings throughout this era, implying that in addition they carry vital dry powder now.

It now stays to be seen whether or not this stored-up USDT will probably be transformed into the cryptocurrency to supply help to the surge within the coming days or not.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $27,400, up 5% within the final week.

BTC has noticed some pullback prior to now 24 hours | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]