[ad_1]

The Bollinger Bands® indicator is among the many most dependable and highly effective buying and selling indicators merchants can select from. Bollinger Bands® can be utilized to learn the pattern power, to time commerce entries, trip trending markets, and discover potential market tops for reversal buying and selling. The Bollinger Band® indicator isn’t a lagging indicator as a result of it adjusts to cost motion in real-time and the indicator makes use of the value volatility to regulate to the present worth habits.

On this article, we present you the right way to use the Bollinger Bands ® indicator to enhance your chart studying abilities and the right way to determine high-probability commerce entries.

Bollinger Bands ® Indicator Defined

We don’t need to get too technical on this article, however understanding the fundamental premise of the indicator will assist us use the indicator extra successfully. If you’re not within the underlying rules of the Bollinger Bands® indicator, you’ll be able to skip forward to the subsequent part the place we cowl some frequent use instances.

Because the title implies, Bollinger Bands® are worth channels (bands) which might be plotted above and under the value motion.

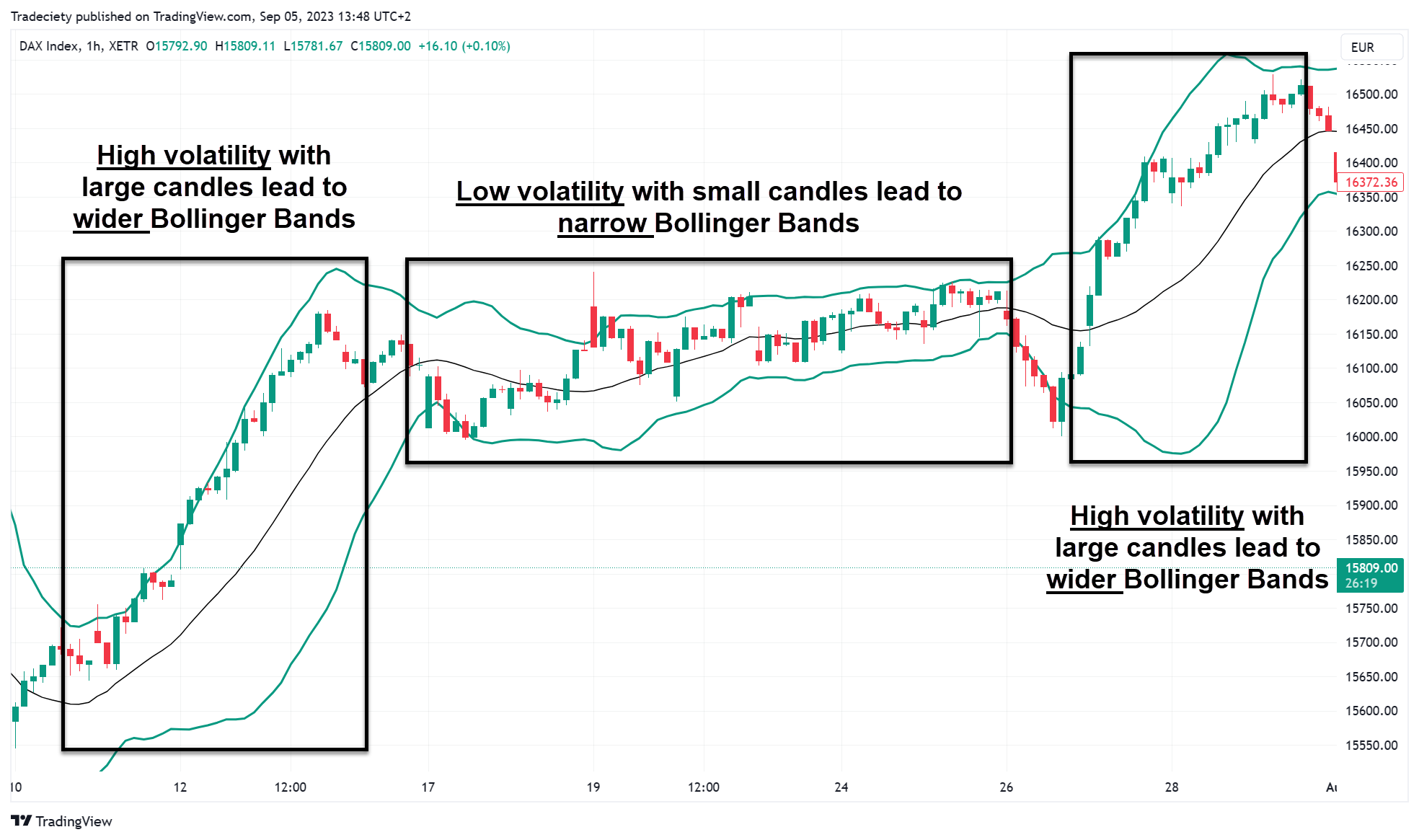

The outer Bollinger Bands® are based mostly on worth volatility, which signifies that they increase when the value fluctuates and traits strongly. Conversely, the bands contract throughout sideways consolidations and low momentum traits. The longer the candles and the candlestick wicks, the upper the volatility is and, due to this fact, the additional aside the Bollinger Bands® are going to be.

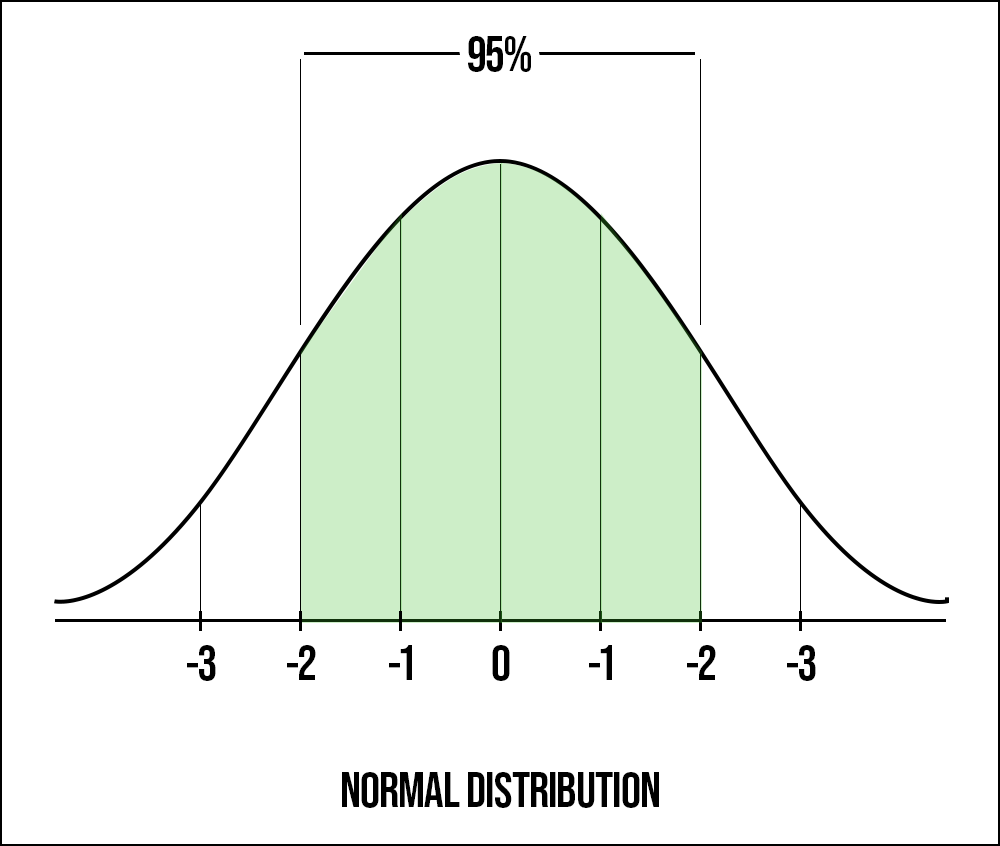

An vital part of the Bollinger Bands ® is the customary deviation. With out getting too technical, the usual deviation measures the value fluctuation and the deviation from the common candle measurement.

A small customary deviation signifies that the candle’s measurement was near the common candle measurement. A big customary deviation means the candles’ measurement was everywhere and deviated strongly from the standard common candle measurement.

The Bollinger Bands ® indicator makes use of two ideas from statistics, the so-called confidence interval, and the regular distribution. By default, the Bollinger Bands ® are set to 2 customary deviations. With a regular deviation of two, we’d say that 95% of all noticed worth factors ought to fall throughout the Bollinger Bands®. The graph under exhibits a traditional distribution graph with the usual deviations on the backside x-axis.

Once more, I don’t need to get too technical, however a small tour is vital to grasp the strategy of the Bollinger Bands® indicator and why it’s so highly effective.

Whenever you hear somebody say “95% confidence interval,” it means they’re fairly sure (95% positive, to be precise) that the common worth candle will fall throughout the vary of the Bollinger Bands ®. For those who’re 95% positive the value will keep throughout the Bollinger Bands ®, you will be assured concerning the worth prediction.

In easy phrases, we’d say that 95% of all the value motion occurs in between the Bollinger Bands®. A transfer exterior of the outer Bollinger Bands ® exhibits a major worth transfer and is a 5% outlier.

The middle of the Bollinger Bands ® is the 20-period shifting common and the right addition to the volatility-based outer bands, particularly once we begin utilizing Bollinger Bands ® for trend-following buying and selling.

Development-Buying and selling with the Bollinger Bands ®

Bollinger Bands ® don’t lag (as a lot) as a result of they at all times change mechanically with the worth motion.

We are able to use the Bollinger Bands ® to research the power of traits and get a variety of vital info this manner. There are only a few issues it is advisable take note of in the case of utilizing Bollinger Bands ® to research trending markets and worth motion:

- Earlier than a brand new pattern emerges, we regularly see a Bollinger Bands ® contraction the place the 2 bands come collectively. This sometimes occurs throughout sideways consolidations earlier than a breakout happens.

- Throughout robust trending phases, the value stays near the outer band and the bands widen as bigger trending candles push the value increased.

- If the value fails to succeed in the outer band and strikes again inside the middle, it exhibits fading momentum. This is sort of a worth divergence.

- Repeated pushes into the outer bands that don’t advance the pattern can usually be an indication of exhaustion and we confer with them as Bollinger Bands ® spikes.

Within the following, we’ll study every Bollinger Bands ® sign individually to get a greater understanding of the right way to use the Bollinger Bands ® in our buying and selling.

Bollinger Bands ® Contraction

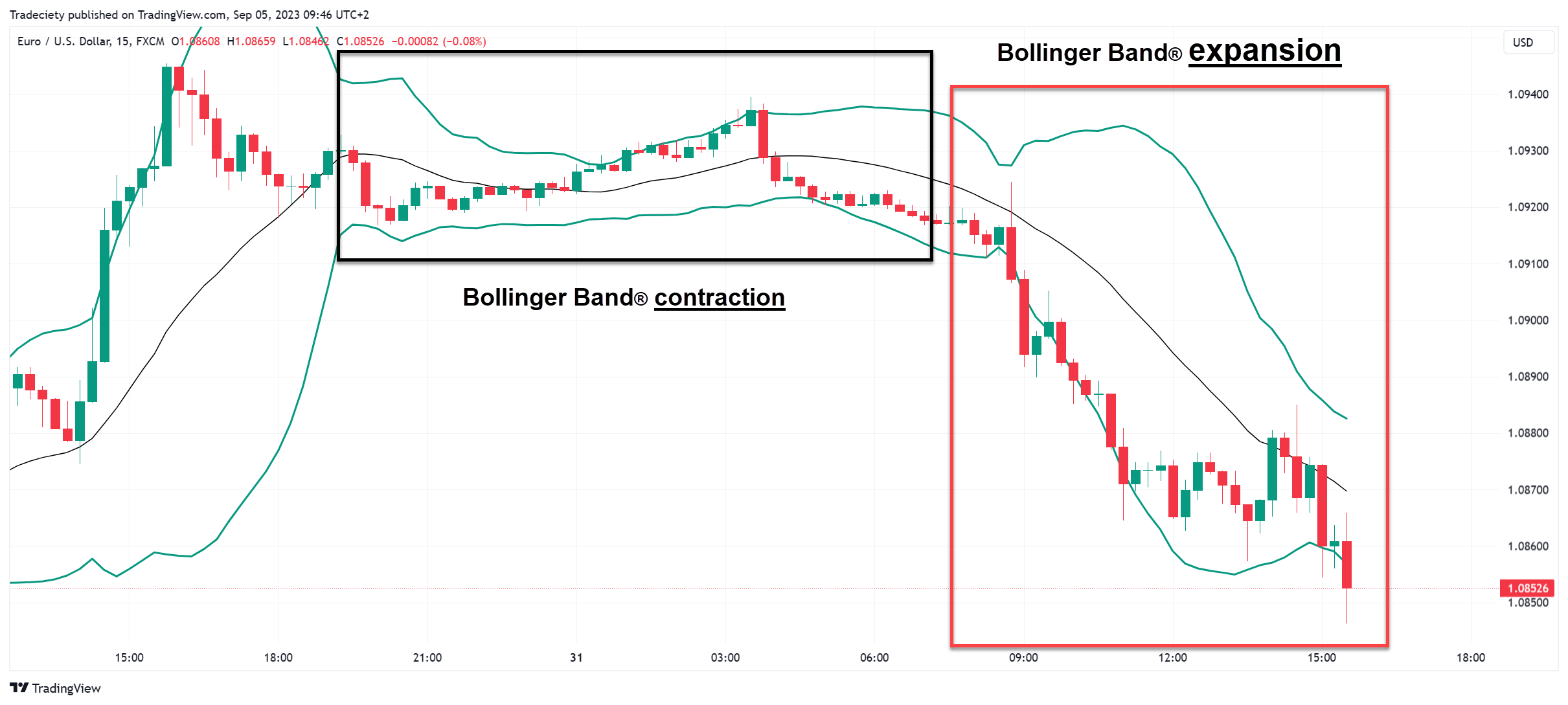

We’re beginning with the Bollinger Bands ® contraction as a result of a contraction usually foreshadows a pattern change or a pattern continuation and is, due to this fact, the primary vital sign.

Within the screenshot under, we will see that the value was in an uptrend first after which began shifting sideways. Through the sideways interval, the candlesticks turned smaller and the Bollinger Bands ® began narrowing. Particularly lengthy contraction intervals will be vital indicators.

After the robust breakout from the contraction, the Bollinger Bands ® began widening instantly, signaling the robust trending worth motion. Throughout trending markets, when the value pushes into one path with lengthy candlesticks, the Bollinger Bands ® widen, confirming the excessive degree of volatility – a deviation from the conventional worth habits.

Bollinger Bands ® Development-Following

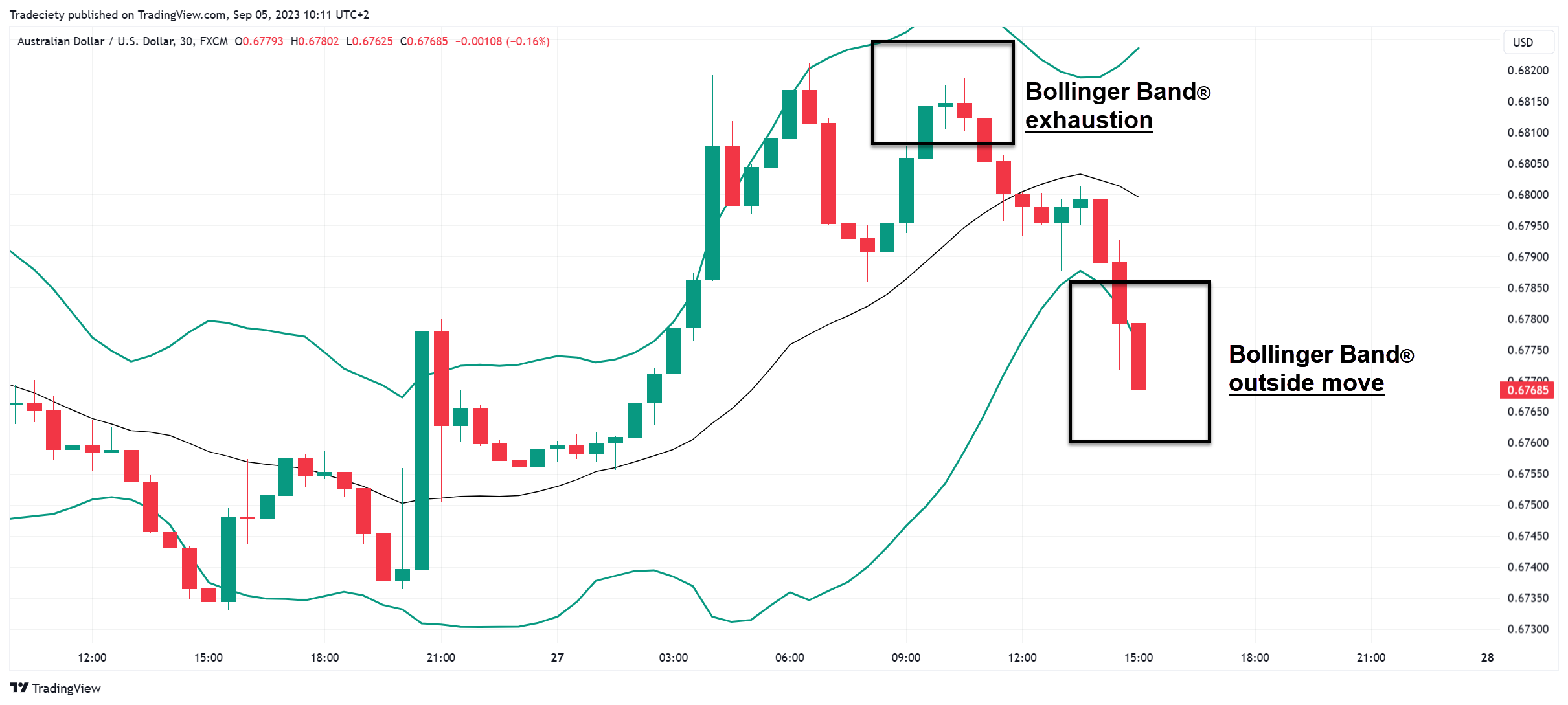

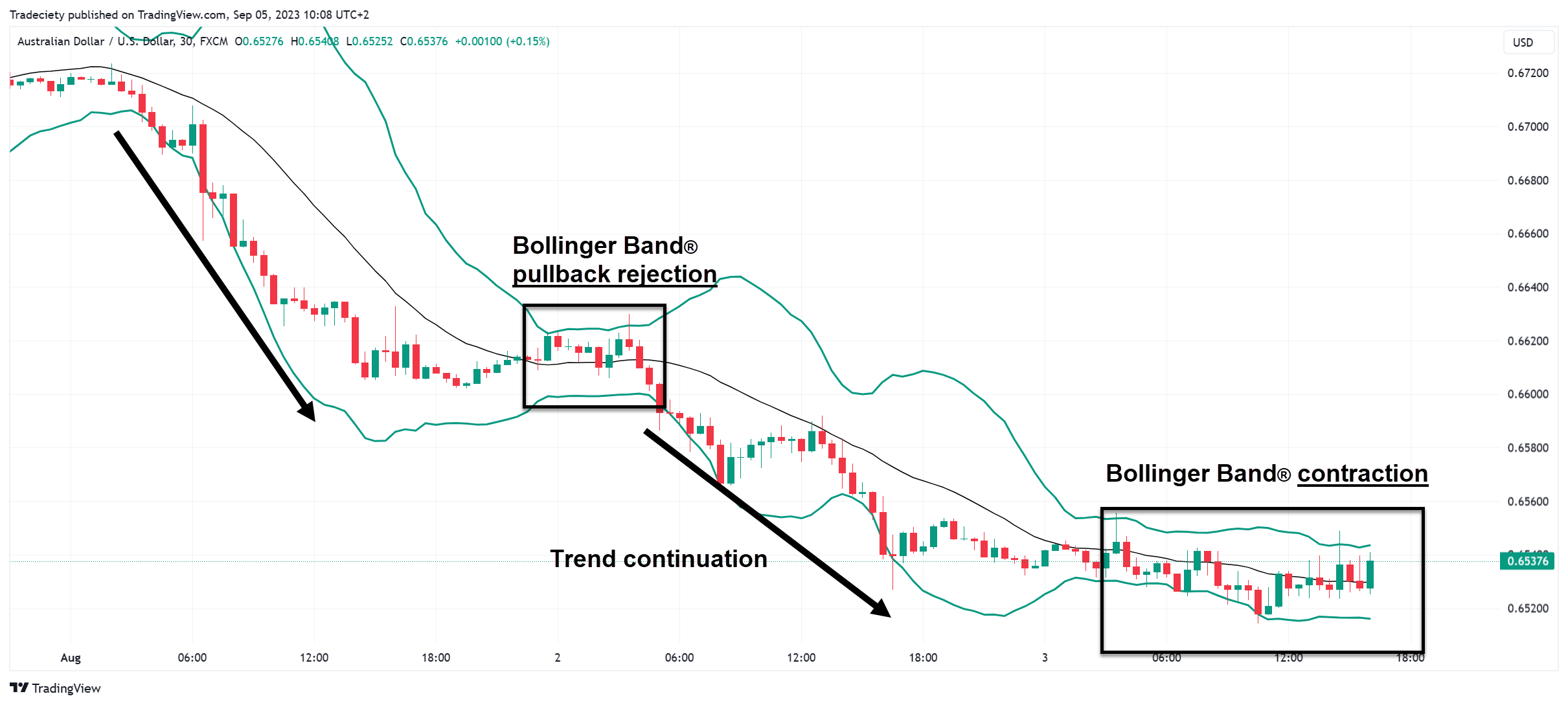

Within the screenshot under, the value first confirmed a Bollinger Bands ® exhaustion. The exhaustion is confirmed when the value fails to succeed in the higher Bollinger Bands ® in an uptrend. Whereas beforehand within the uptrend, the value was in a position to attain and commerce exterior the higher band, through the exhaustion, the value couldn’t proceed the trending section. That is the primary signal of a pattern reversal.

Subsequent, the value moved all the best way into the alternative Bollinger Bands ® and began buying and selling exterior the decrease band. The value confirmed excessive power and the value was even in a position to shut exterior the decrease band. As now we have realized, a lot of the candlesticks will fall contained in the Bollinger Bands ®. A transfer exterior the bands exhibits, due to this fact, excessive pattern power.

After the push exterior the decrease Bollinger Bands ®, the pattern continued to the draw back and the value stayed very near the decrease band. Sturdy continuation pushes under the decrease band verify the pattern path.

Lastly, the Bollinger Bands ® began contracting and the bands narrowed when the value began shifting sideways with smaller candlesticks. A bullish pattern change may now be underway when the value begins pushing into the higher Bollinger Bands ®.

Bollinger Bands ® Pullback Buying and selling

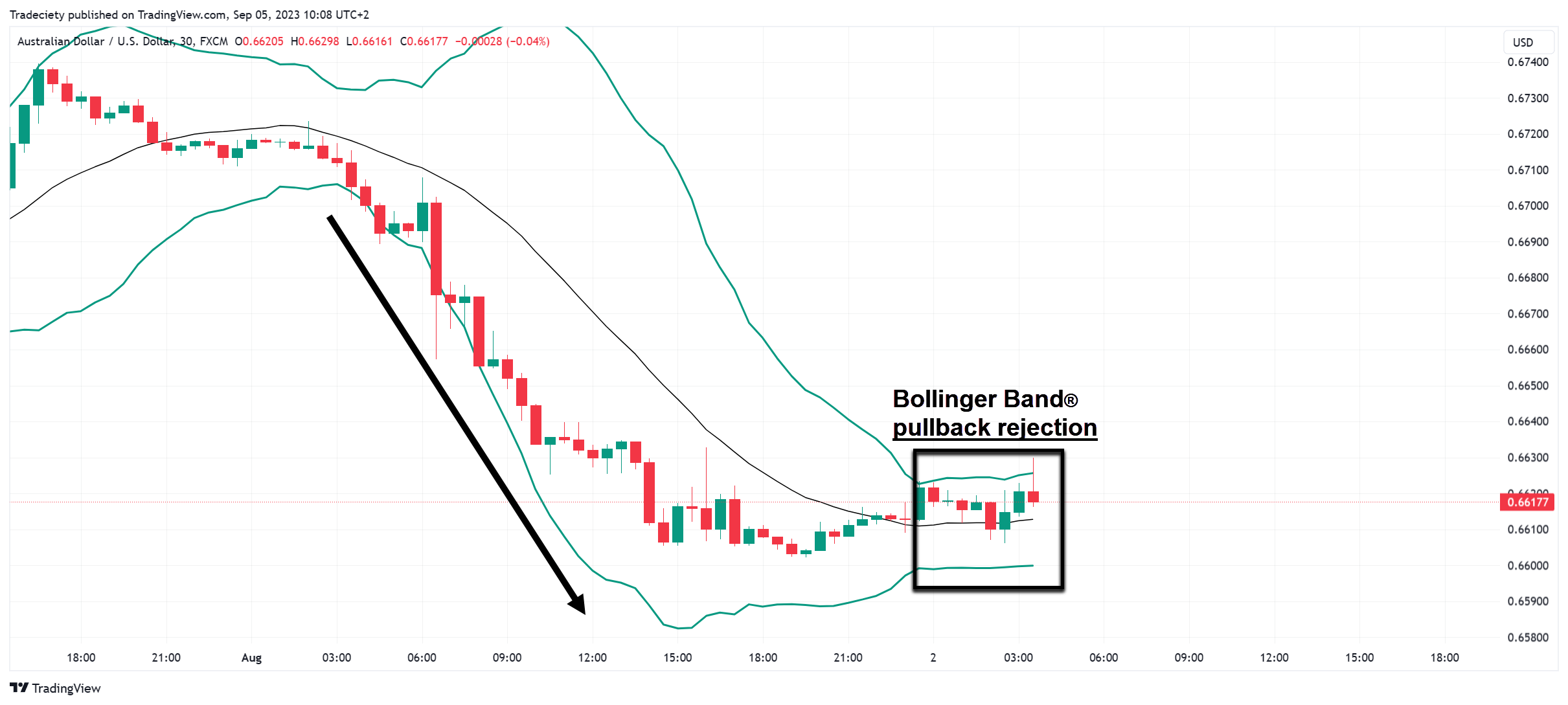

To date, now we have seen that breakouts from contractions can foreshadow new trending phases and a powerful push exterior of the Bollinger Bands ® will be seen as a pattern affirmation. However the Bollinger Bands ® indicator will also be used for trend-following pullback buying and selling. As soon as a pattern is on its manner, merchants sometimes look ahead to the value to indicate a pullback section. A pullback is a brief pause within the trending market the place the value strikes sideways or makes a brief transfer into the alternative pattern path. Evaluating the pullback phases can inform merchants lots concerning the underlying trending dynamic.

The screenshot under exhibits that the value is in an total down-trending market section as a result of the value stored pushing into the decrease bands. Now, the Bollinger Bands ® began narrowing and the value even reached the upper Bollinger Bands ®. The response across the increased band can inform us lots concerning the market habits. On this instance, the market simply briefly poked above the upper Bollinger Bands ® after which instantly was rejected. Such a fast rejection transfer will be seen as a rejection of the bullish shopping for try. If such a rejection is adopted by a powerful bearish candle, this sequence could foreshadow extra promoting to come back.

As we will see, after the Bollinger Bands ® rejection, the value began shifting again into the decrease bands instantly and the downtrend continued. The short rejection, adopted by the robust bearish transfer was a perfect pattern continuation sign.

Bollinger Bands ® Spikes

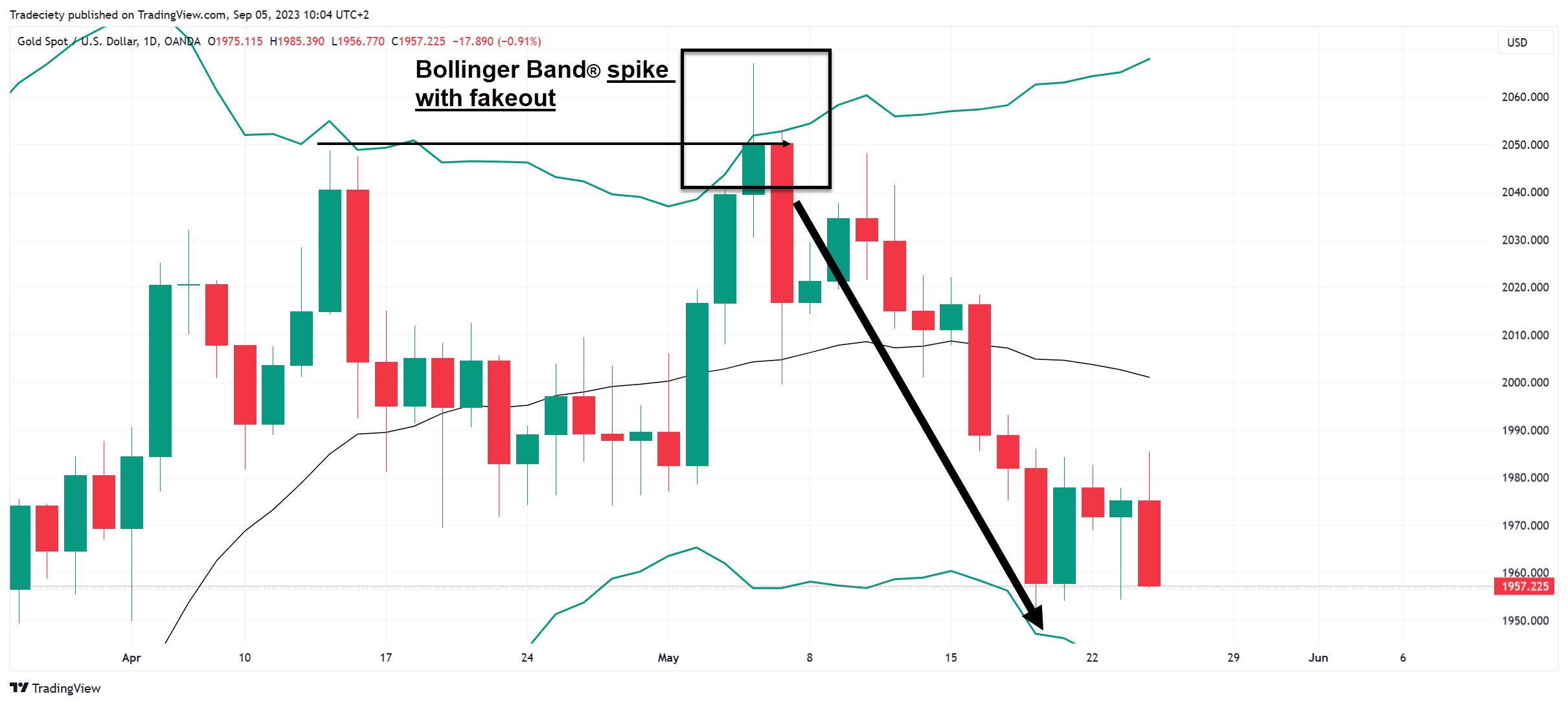

Lastly, we will additionally use the Bollinger Bands ® for reversal buying and selling. For that, we’re going to study the Bollinger Bands ® on the upper timeframe, the Day by day.

On the Day by day timeframe, we search for a worth candle that spikes by way of the outer band however will get rejected instantly. The stronger the rejection, the higher the sign is.

Within the screenshot under, we additionally see that the spike happens with a fakeout, a failing breakout above the final highs.

Though you’d use the Bollinger Bands ® sign from the upper timeframe to time your trades on the decrease timeframe away from the spike, we will see that the value did transfer decrease on the upper timeframe after the spike.

Bollinger Bands ® spikes generally is a nice increased timeframe sign. Particularly when mixed with different confluence components comparable to increased timeframe assist and resistance ranges and different exhaustion indicators.

Ultimate Phrases

The Bollinger Bands ® indicator is a multi-purpose buying and selling software that can be utilized in some ways as now we have realized all through the article. Though the Bollinger Bands ® are categorized as an indicator, using volatility and the idea of the usual deviation flip the Bollinger Bands ® indicator into an vital worth motion buying and selling software.

The Bollinger Bands ® indicator is good for trend-following buying and selling, and trend-continuation buying and selling, and might even be utilized by reversal merchants.

As at all times, we advocate making an attempt the Bollinger Bands ® indicator in a backtest first earlier than shifting on to utilizing it in your demo buying and selling to guage its effectiveness and discover the completely different use instances of the indicator.

[ad_2]