[ad_1]

Most buyers pay an excessive amount of for his or her startup investments.

That’s an issue.

When you overpay, you’ll by no means make the sorts of income that might doubtlessly change your life.

So at this time, I’ll reveal one of the vital vital guidelines for startup investing:

It’s my #1 rule for making certain that you simply — and I imply you — don’t overpay.

Introducing Mike Maples, Jr.

To set the stage right here, let me introduce you to Mike Maples, Jr.

Maples is the co-founder of a wildly profitable enterprise capital agency referred to as Floodgate.

Mike has been on Forbes’ “Midas Record” a whopping eight instances for having a golden contact along with his startup investments. His offers embrace mega-hits like Twitter, Clover Well being, Okta, ngmoco, Bazaarvoice, and Demandforce.

Moreover, earlier than changing into an investor, Mike was founding father of two startups that went public: Tivoli Programs (IPO TIVS, acquired by IBM) and Motive (IPO MOTV, acquired by Alcatel-Lucent).

In different phrases, Maples is aware of a factor or two about startups and startup investing.

And final week, he chimed in on Twitter a couple of startup-related challenge that’s close to and expensive to my coronary heart: overpaying for early-stage (seed-stage) startup investments.

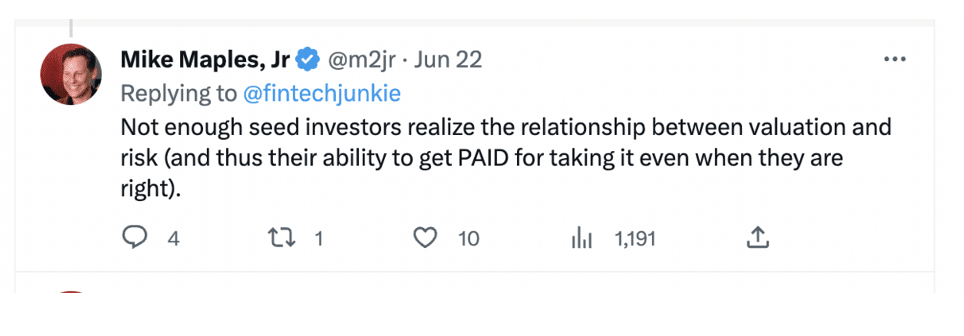

As he wrote:

To elucidate what his tweet means, let me begin at the start — with the “10x rule”…

The “10x Your Cash” Rule

When Wayne and I first launched Crowdability, we carried out a deep analysis venture.

Our objective was to determine a confirmed course of for choosing profitable startup investments.

Over the course of a yr or so, we sat down with greater than three dozen of essentially the most profitable startup buyers within the nation. On the time, these buyers had collectively backed greater than 1,080 startups, and generated a number of billion {dollars} in income.

And step by step, they taught us dozens of instruments and “methods” to determine successful investments.

However of all their methods, one has been essentially the most invaluable to us by far:

Learn how to determine the investments that may return 10x your cash.

Go together with the Odds

In case you didn’t know, startup buyers earn their income in two most important methods:

1. The startup goes public in an Preliminary Public Providing (IPO); or

2. The startup will get acquired.

IPOs can lead startup buyers to huge income, however IPOs occur very sometimes.

Essentially the most widespread approach for startup buyers to earn their income is thru an acquisition — in different phrases, when a startup they invested in is taken over by one other firm.

To place the numbers in perspective: In 2020, there have been about 480 IPOs. However throughout the identical time-frame, there have been about 12,000 takeovers.

So, how can we spot potential takeover targets early — so we are able to money out for large beneficial properties if and once they get acquired?

“Each Battle is Gained Earlier than It’s Ever Fought”

To reply this query, let me inform you about one of many buyers we met throughout our startup analysis venture.

Earlier than this gentleman turned a enterprise capitalist, he was a high-ranking navy officer.

As he peppered our conversations with references to “storming the seashores of Normandy” and “the Battle of Little Spherical Prime,” he usually talked about a selected expression:

“Each battle is gained earlier than it’s ever fought.”

As these phrases relate to investing, right here’s what he meant:

Sure actions you’re taking earlier than you make an funding can decide your final success. And one of the vital vital of those actions is that this:

Filtering out investments primarily based on their valuation.

The Significance of Valuation

Valuation is one other approach of claiming “market cap.” It’s the full worth of an organization. For public firms, we are saying market cap. For startups, we are saying valuation.

And right here’s the factor:

Regardless of what you learn within the press about big-ticket takeovers — like Fb shopping for WhatsApp for $19 billion — the gross sales value for many startups is lower than $100 million.

In actual fact, in line with PricewaterhouseCoopers and Thomson Reuters, nearly all of acquisitions happen beneath $50 million.

So, in case your objective is to earn 10x your cash on a startup which may get acquired for $50 million, how do you “win this battle”?

Easy: make investments at valuations of $5 million or much less!

When you make investments at valuations which are larger than $5 million, you may very effectively be overpaying to your funding!

Exceptions To Each Rule

Clearly, there are exceptions to each rule.

For instance, in case you have an professional to information you, you possibly can all the time take into account investing in startups which are extra extremely valued. In spite of everything, many buyers thought of firms like Fb or Airbnb “wildly overvalued” once they have been value $10 million or $100 million or $1 billion. Now they’re value lots of of billions.

However once you’re simply getting began in early-stage investing, limiting your investments to startups which are valued at $5 million or so is a great technique to stay with:

This technique will provide you with the best possibilities of doubtlessly incomes 10x your cash.

That’s what Mike Maples’ tweet is all about:

It’s about not overpaying to your startup investments.

And that’s what we’re right here to show you about each week.

We’re looking for you!

Comfortable Investing.

Finest Regards,

Founder

Crowdability.com

[ad_2]